Home Equity Vs Refinance

Acts as a second mortgage.

Home equity vs refinance. Can be used to consolidate higher interest debt. Circumstances should dictate the most appropriate option. Home equity loan vs. A traditional refinance and a home equity loan are similar in that both loan types evaluate your credit score to determine whether youre a high risk.

Home equity line of credit. Cash out refinances make no sense except. Another option would be to take out a home equity line of credit heloc. A home equity loan.

Potentially lower interest rates. If youre interested in borrowing against your homes available equity you have choices. Determining which type of. March 7 2019 5 min read.

Homeowners should understand both options and make. Learning about the compo. The wisdom of getting a home equity loan or refinancing a first mortgage to get the cash a homeowner needs has no right or wrong choice. One option would be to refinance and get cash out.

It also can be a source of ready cash should you need it through refinancing or a home equity loanrefinancing pays off your. Your home is not just a place to live and its not just an investment. Generally need to be paid back sooner. Cash out refinance vs home equity loan.

If you already have a mortgage a home equity loan will be a second payment to make. Can be repaid over 15 or 30 years. Replaces your existing mortgage loan. Mortgages and home equity loans are both ways to borrow that involve you pledging your home as collateral or backing for the debt.

Gina pogol the mortgage reports contributor. May be harder to qualify for. Can offer you a lump sum based on your home equity. May be easier to qualify for.

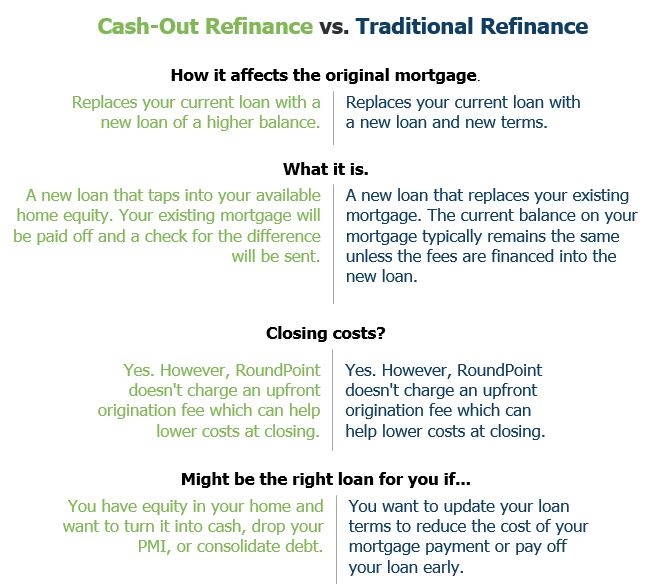

The better deal might surprise you. A home equity loan and a cash out refinance are two ways to access the value that has accumulated in your home. Home equity loan. Here are some of the key differences between a cash out refinance and a home equity line of.