Fha First Time Home Buyer

Heres whats covered when to take it and how much it will cost.

Fha first time home buyer. Fha fha first time home buyer mortgages for condominium units section 234c this program insures the loan for a person who purchases a unit in a condominium building. How do we do it. The calhfa first time home buyer programs such as myhome assistance calhfa zero interest and cal eem grant offer down payment and closing cost help. What does fha have for you.

Some types of loans require 10 20 of the purchase price. Making a mortgage down payment can be difficult for some first time home buyers but there are ways to make your them more affordable. Fha loans have been helping people become homeowners since 1934. Thats why many first time homebuyers turn to huds fha for help.

Fha fha first time home buyer bad credit mortgage lenders fha mortgage approvals with min 580 fico score with 35 down. Discover which are best for you and learn how to get started. The federal housing administration fha which is part of hud insures the loan so your lender can offer you a better deal. If you buy a hud home for example your deposit generally will range from 500 2000.

First time home buyer options with fha loans. The amount of your earnest money varies. The most significant fha first time home buyer benefits are the reduced down payment only 35 percent for individuals with a credit score of 580 or higher and the lower credit score requirements. They are particularly great for first time buyers because they do not actually require credit at all.

A first time home buyer class is often required to get a grant or down payment assistance. The more money you can put into your down payment the lower your mortgage payments will be. And fha mortgage loan approvals down to 530 with 10. Fha loans are meant for lower income or first time home buyers with easier down payment and credit guidelines than many other loans.

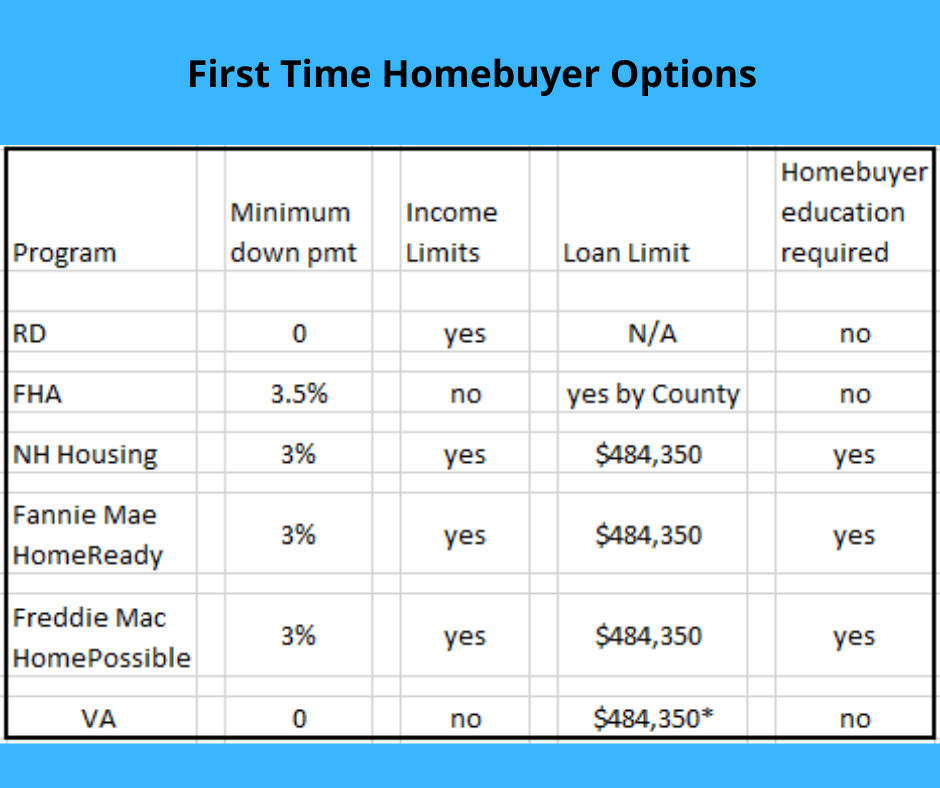

Buying your first home. First time home buyers have a lot of different loans and programs to choose from including fha va and usda loans.