What Is The Interest Rate On A Home Loan

In the upcoming policy review that is scheduled on 5 december 2019 the reserve bank of india rbi is expected to reduce the repo rate by 25 basis points.

What is the interest rate on a home loan. The reduction of repo rates will see home loan interest rates fall below 8. Even a slight difference in rates can drive your monthly payments up or down and you could pay thousands of. When a bank quotes you an interest rate its quoting whats called the effective rate of interest also known as the annual percentage rate apr. Your rate will also be calculated based on the loan to value ratio which considers the percentage of the homes value.

In general homebuyers with good credit scores of 740 or higher can expect lower interest rates and more options including jumbo loans. But if you pay interest monthly you must convert that rate to a monthly rate by dividing by 12 for your calculations. Mortgage interest rates determine your monthly payments over the life of the loan. Mortgage rates are determined based on your credit score the loan to value ratio of the home and the type of loan youre applying for.

Compare lender aprs loan terms and lock in your rate. For example a 12 annual rate becomes a 1 monthly rate. The apr is different than the stated rate of interest due to the. Heres how these work in a home mortgage.

For example a 12 annual rate becomes a 1 monthly rate. Multiply it by the balance of your loan which for the first payment will be your whole principal amount. Interest rate will change under defined conditions also called a variable rate or hybrid loan. So for example if youre making monthly payments divide by 12.

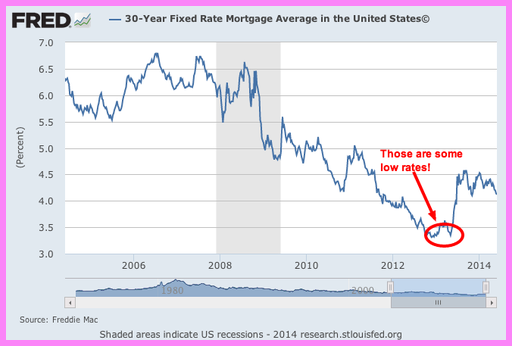

Rate of interest on home loans may reduce below 8 soon. You also will be in a better position to negotiate your interest rate.