Va Home Improvement Loan

Simultaneously purchase and improve a home.

Va home improvement loan. To refinance an existing. If youre eligible for the va home loan program and you want to rehabilitate a home the va home improvement loan programs could be important for you to understand. Learn more about the different programs and find out if you can get a certificate of eligibility for a loan that meets your needs. This went from a great 35000 to an unlimited amount.

There also isnt much of a path for veterans who want to buy a fixer upper and borrow additional funds to improve the property. Va home loans can be used to. 48 home improvements that can be added to your va loan the va home loan program offers eligible borrowers a multitude of advantages. Today va loan holders and eligible borrowers can use the vas loans for alterations and repair to buy or refinance a home that needs repairs.

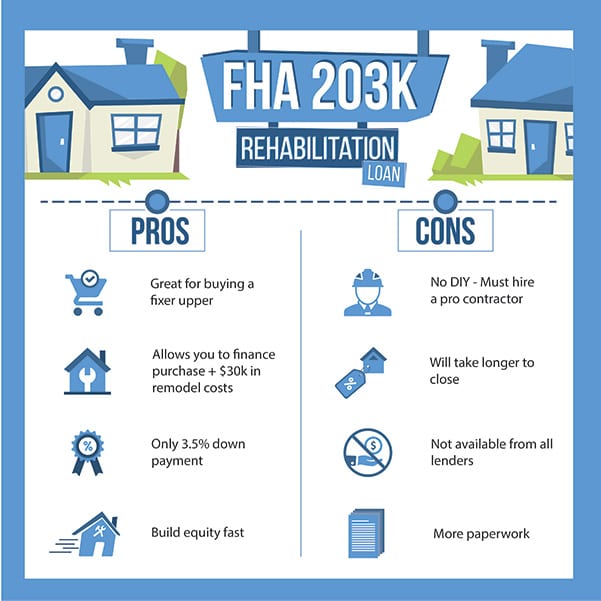

Recent va renovation loan enhancements. Depending on who you choose the paperwork process can be dragged out longer than you want. Just like the prior level renovation costs includes the actual improvement costs a contingency reserve and renovation fees. In those cases veterans and military buyers might learn more about the fhas 203k loan program which does allow for building in additional money for rehab.

Buy a manufactured home andor lot. Improve a home by installing energy related features or making energy efficient improvements. No money down no private mortgage insurance required accessible refinancing options no established minimum credit scores and service related disability options anchor the loans appeal. The biggest improvement in our va home improvement loan is the increased amount of renovation costs allowed.

As mentioned above va renovation loans of this kinds are often capped at a fixed amount which may vary slightly from lender to lender. Buy a home a condominium unit in a va approved project. Va home loan types we offer va home loan programs to help you buy build or improve a home or refinance your current home loanincluding a va direct loan and 3 va backed loans. Closing on a va home improvement loan requires an accurate repair bid be submitted by a local licensed contractor.