Home Equity Loan Fixed Rates

Find out if a fixed rate loan option could help meet your home equity needs.

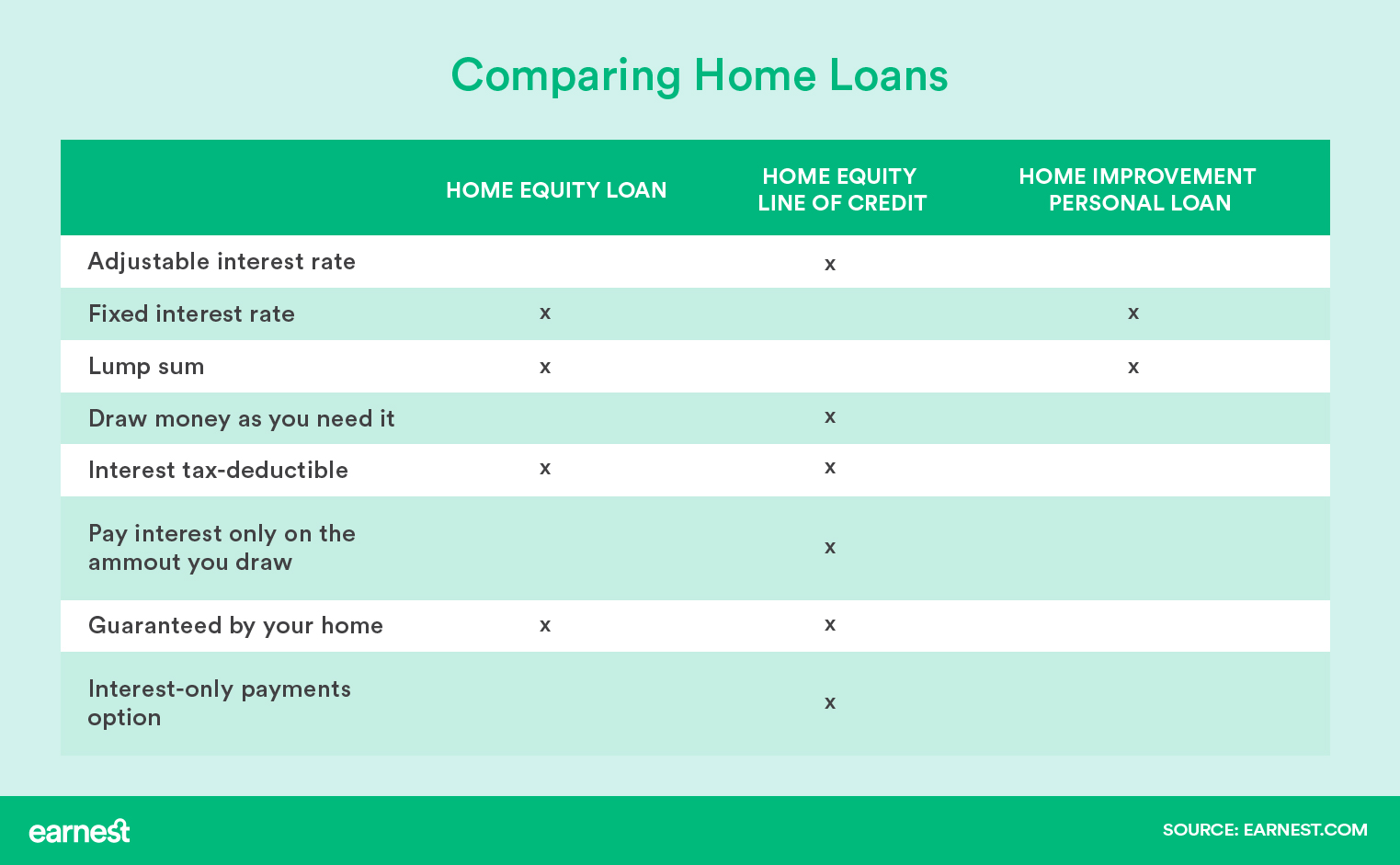

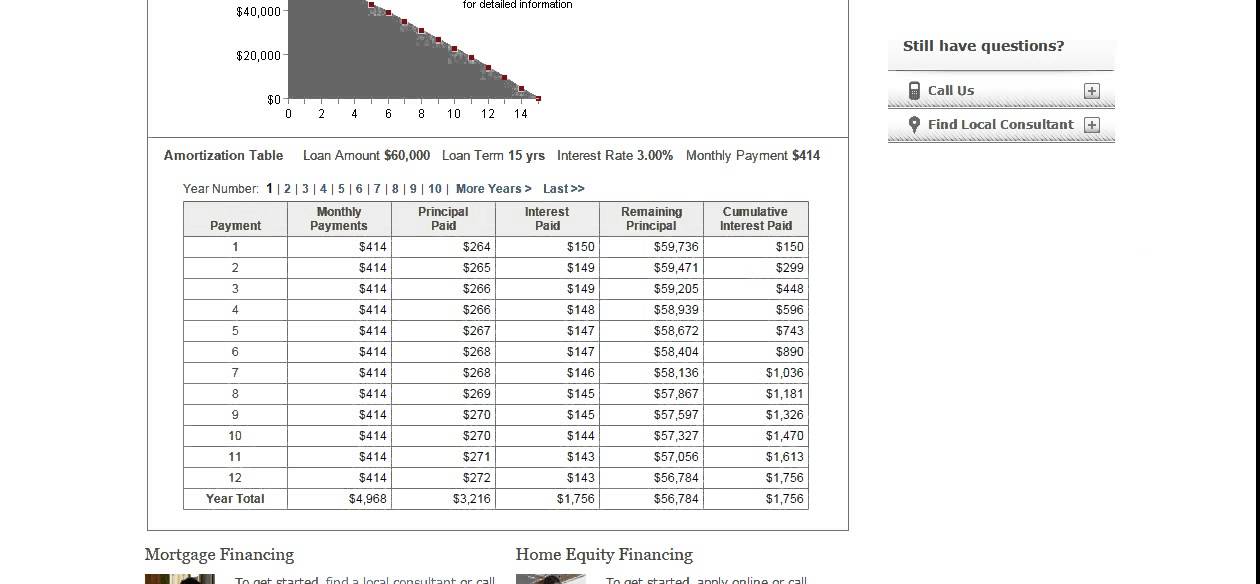

Home equity loan fixed rates. With a fixed rate loan option youll enjoy the predictability of fixed payments when you convert some or all of the balance on your bank of america variable rate heloc. With a home equity line of credit you are only required to make interest payments during the draw period. With a home equity loan you make fixed payments of principal and interest. A home equity loan is a loan that you take out against the value of your home.

In order to receive the lowest rate advertised a set up of automatic payments from a us. If youre considering a home equity loan its important to take the time to find the best home equity loan rates before moving forward in the borrowing process. Citi best for helocs. A home equity loan has a fixed rate.

Rates may vary based on ltv credit scores or other loan amount. Most home equity loans offer fixed interest rates meaning that the interest rate stays the same even if market conditions change. Discover best for low interest rates. If you dont repay the loan as stated in the terms of your agreement you risk defaulting on your loan and your lender may foreclose on your home.

Features benefits leverage your homes equity borrow up to 80 of the equity in your home borrow up to 75 of the equity in your home for loans greater than 100000 borrow 5000 350000 get cash in a lump sum fixed rate for the life of the loan 5 10 and 15 year terms available repayments can be made bi weekly or monthly. As of february 22 2020 the fixed annual percentage rate apr of 405 is available for 10 year second position home equity installment loans 50000 to 250000 with loan to value ltv of 70 or less. Our top picks of 2020 have an efficient application process explain loan options clearly and. Bank best for borrowers with good credit scores.

In either case the term of the home equity loan is fixed usually at 10 or 20 years. Traditionally if you wanted to borrow against the equity in your home you could either get a fixed rate home equity loan or draw money against a home equity line of credit heloc a closed end. Connexus home equity loan rates are also on par with those of other financial institutions on this list starting as low as 4482 percent. A home equity loan can be either a fixed rate equity loan or a variable rate sometimes fixed rate equity line of credit or heloc.