Home Equity Interest Rates

Think about a.

Home equity interest rates. Interest rates are super low and the federal reserve after cutting rates three times in 2019 has indicated that rate hikes are not on the. Homeequity bank prime rate. Connexus home equity loan rates are also on par with those of other financial institutions on this list starting as low as 4482 percent. Rates may vary based on ltv credit scores or other loan amount.

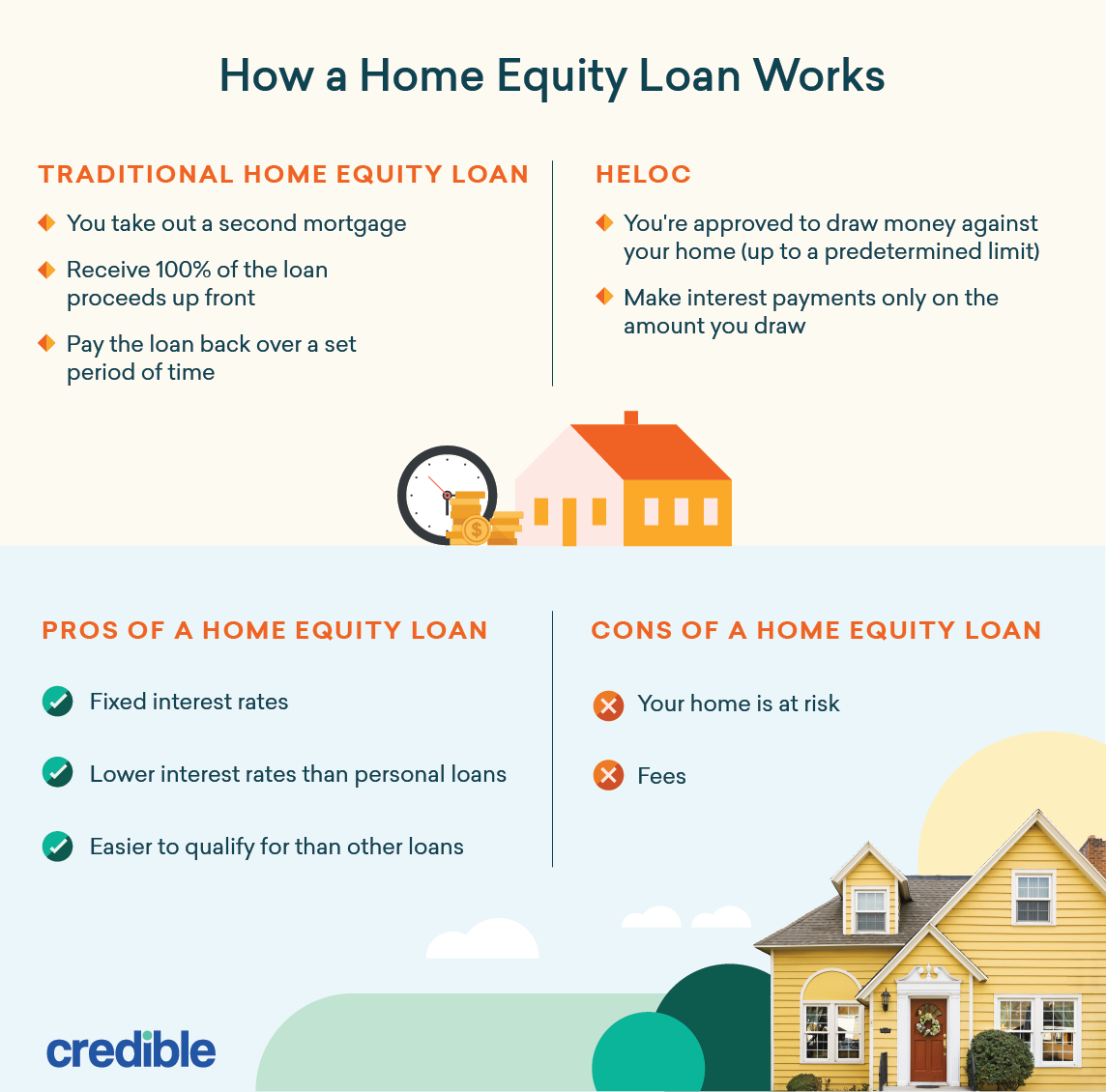

Though rare some home equity loans have variable interest rates. Most home equity loans have fixed interest rates so your rate stays the same over the life of the loan. This can make it easier to plan for the future since your monthly payments dont change. Home equity loans and helocs are second mortgages which means in the event of a foreclosure the home equity lender is second in line to get repaid after the lender on your first mortgage or the loan used to purchase your home.

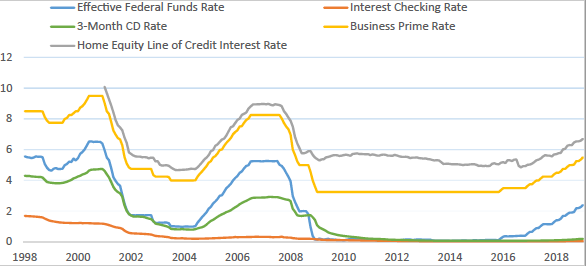

A variable rate means that the interest rate in a loan can fluctuate over time if the benchmark such as the prime rate changes. Current chip reverse mortgage rates contracts 21 33 current homeequity bank income advantage rates contract 31 33 current chip reverse mortgage with additional funds rates contracts 31 33 other chip reverse mortgage rates and discounts contracts 17 20 current chip max rates. Plus there are no application annual or prepayment fees. Because of this lenders typically charge higher interest rates on home equity loans and helocs than on first mortgages.

Home equity line of credit heloc interest rate discounts are available to clients who are enrolled or are eligible to enroll in preferred rewards at the time of home equity application for co borrowers at least one applicant must be enrolled or eligible to enroll. A home equity line of credit or heloc has an adjustable rate of interest attached to paying it off which means that your payments can fluctuate based on the federal funds rate. Its the best of times for home equity borrowers. Plus there are no application annual or prepayment fees.

In order to receive the lowest rate advertised a set up of automatic payments from a us. As of february 22 2020 the fixed annual percentage rate apr of 405 is available for 10 year second position home equity installment loans 50000 to 250000 with loan to value ltv of 70 or less.